As a controller, how do you move beyond the delivery of reports to an actual role as business partner within your organization? Or how can you, as a controller, broaden your profile, for example, from cost controlling to commercial controlling or from a production environment to a service environment?

Experienced controllers Astrid Maertens and Steven Verniers shared their best practices and insights from their years of experience as Project Consultant in controlling at various companies during the webinar ‘Level up your potential as a controller: integrate consultancy skills in your day-to-day.’

The webinar was moderated by Nico De Neve, Learning & Development Expert at TriFinance with more than 10 years of experience in controlling himself.

- Provide a clear structure and overview

- Make sure to have maximum time available for analysis

- Always ask “Why?”

- Play your role as a bridge between the business and work together with the business

- Set the example yourself and take on a leadership role

According to LinkedIn, there are about 7,000 professionals working as a controller today. This is a diverse group, with job titles ranging from Financial Controller, through Regional Controller and Sales Controller to Group Business Controller. How their role is specifically shaped, is often highly dependent on a company’s organizational structure. For example, the focus may be on a specific division or region, but equally on sales, production or another department within the company.

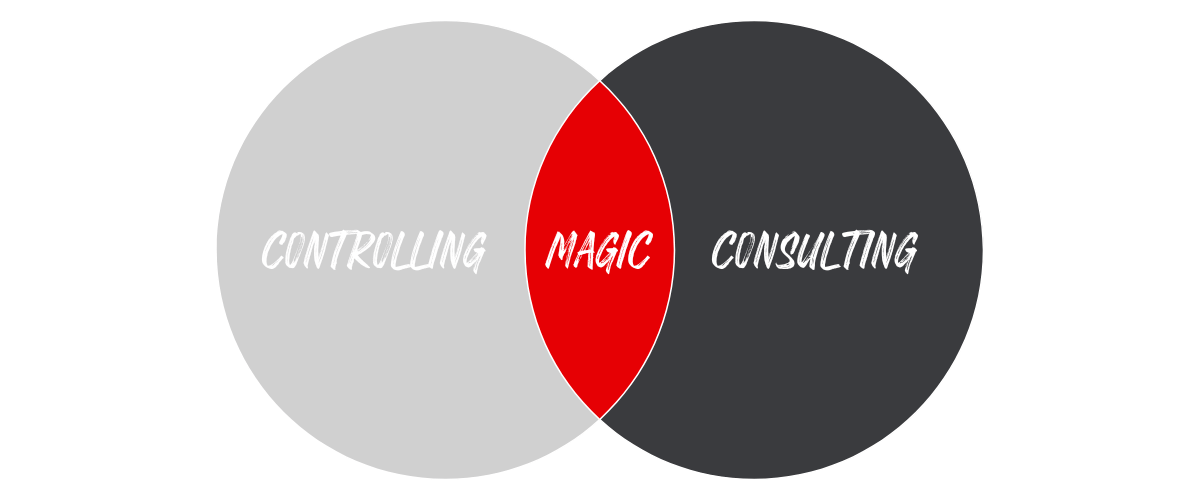

Despite this diversity, controllers share a common skillset and responsibilities. All controllers engage in variance analysis, budgeting and forecasting. Moreover, there is an interesting overlap between skills a controller needs and the skills a consultant deploys on virtually every project. Based on this, Astrid and Steven highlighted 5 tips that every controller can put to use in daily practice.

1. Provide a clear structure and overview

One of the first steps for a controller in a new environment is to bring structure.

This starts with a well-organized digital workspace, including a clear folder structure and a closing checklist. A best practice can be to number the different steps in the closing in a closing manual or checklist and also adopt the same structure in the folders and documents you use for this purpose.

This approach is not only very useful for a handover, but a seasoned controller can also benefit from such a structured approach. It puts procedures and practices in focus and exposes possible optimization opportunities.

2. Make sure to have maximum time available for analysis

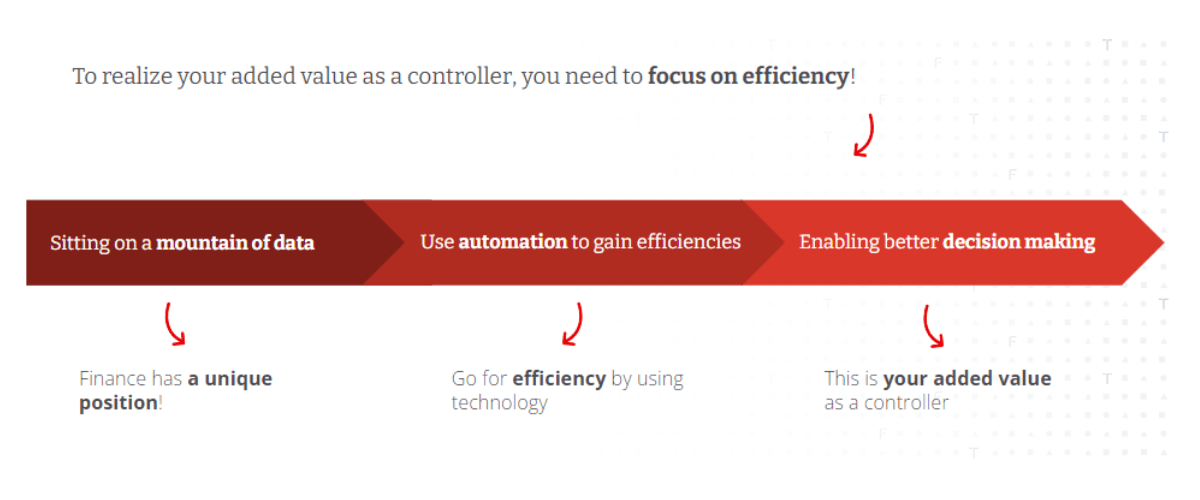

As a controller, you have access to an abundance of data, both financial data and business data. The added value of a controller is to turn that data into analyses that allow the business to make more informed decisions.

This sounds like an open door, but nevertheless, much of controllers’ time is often lost merging data from different systems or creating reports, leaving less time for valuable analysis.

Automations can provide a solution here. For example, consider using Power Query and Power Automate to automate repetitive manual operations with no added value.

At company level, the duties of controllers can also be reviewed. For example, does it add value for a plant controller to process production orders or could such technical tasks be better performed by someone else? In this way, the controllers can be freed up to perform more in-depth analyses. However, it remains a continuous balancing act to ensure that the controller retains sufficient insight into the elements that have an impact on the costs or revenues he or she scrutinizes.

3. Always ask “Why?”

When you are a Project Consultant in controlling ensuring continuity within a company, you have to ask a lot of questions to become familiar with the company in general and controlling processes in particular.

A day without asking “Why?” is a lost day as a controller.

Nico De Neve, Learning & Development Expert at TriFinance

From a fixed role, you might as well look at the situation with a critical eye. Why are the various steps necessary to get to a particular report? Why doesn’t a process run the same way at two production sites of the company? Why do we create this report and how does the business use it? Do any elements need to be changed in a report so that the business can use it better? Or is a report not being used and might as well be discontinued so the time can be invested in another analysis?

All “why” questions that can prove their worth!

4. Play your role as a bridge between the business and work together with the business

Analysis in itself is not enough to solve problems. Controllers must therefore cooperate with the various departments within a company: from production, to IT, to marketing. Communication skills are essential here, as controllers often act as a bridge between different business units.

By investing in the relationship with your stakeholders, you can achieve a better understanding of the figures on both sides and thus generate a positive effect on the business results in the long run.

Astrid Maertens, Project Consultant at TriFinance

Recurring meetings with the business can help the controller, on the one hand, to better understand the figures and, on the other hand, to make the financial impact of decisions clear to the various stakeholders. This leads to more in-depth analyses and better cooperation between controllers and other departments. For example, it can be particularly valuable as a controller to dive into the P&L together with the sales department beyond sales revenue.

5. Set the example yourself and take on a leadership role

By collaborating with the business and sharing insights from business data, as a controller you cannot only facilitate change within a company, but also take on a real leadership role.

For example, think of the budget process: by proactively addressing your stakeholders and explaining how the budget is structured, which elements are included in the cost items and what the financial impact of a particular action is, you can help determine the direction.

Nothing prevents you as a controller from taking initiative and taking the first steps. Your role is not only to check the numbers, but also to forecast them. That way, as a controller, you can really make an impact.

Steven Verniers, Project Consultant at TriFinance

Or by taking the initiative yourself to set up a report on the overspend on a particular expense, you can prompt the business to scrutinize spending more closely. Similarly, if there is recurrent missing data that prevents your as a controller from making the right analysis, you can look for the cause of the issue and discuss with your stakeholders a plan to address it.

Such small-scale initiatives can have a big impact and significantly increase your added value as a controller.

Related content

-

Blog

Advancing in bookkeeping through consultancy: Yassine's story

-

Reference case

Building sustainable structures for a nonprofit through skills-based employee volunteering

-

Reference case

Transforming Finance operations for strategic growth in a family-owned business

-

Article

A skyline of possibilities: how TriFinance consultants seize opportunities and accelerate their growth

-

Article

From bookkeeping firm to a dynamic and versatile role as Bookeeping Consultant at TriFinance

-

Event

E-Invoicing webinar: countdown to 2026 compliance