Since 2011, governments around the world have started mandating e-invoicing. One of the main reasons to make e-invoicing mandatory is to close the VAT-Gap. By implementing a clearance model, every invoice will be approved by the local Tax Authority. In this way, the authority gains control over the entire invoice flow in their country. As a company, there are multiple approaches to stay compliant in e-invoicing. Is your organization approaching e-invoicing compliance the right way?

In 2030, 95% of all organizations have implemented e-invoicing

Last year alone, more than five countries have implemented mandatory electronic invoicing for B2B, B2C, or B2G. Furthermore, multiple countries have announced they will implement a clearance model between 2021 and 2023.

Reports suggest that by 2025 all countries in the world will have some form of mandatory electronic invoicing. From my perspective, 2025 will be a bit too soon. But with the current rate of announcements and implementation of mandatory electronic e-invoicing, I expect that by 2030 95% of all the countries in the world have implemented some form of mandatory e-invoicing.

Why your organization needs to be prepared for global e-invoicing

Multiple countries have already announced mandates when it comes to e-invoicing. Countries tend to announce these regulations well in advance, to give organizations the time to adapt. Nonetheless, countries can decide to implement regulations within a short period of time. For example, Saudi Arabia published a consultation on the draft bill for mandatory e-invoicing on the 17th of September 2020, published the regulations on the 4th of December 2020 and as of the 4th of December 2021, all taxpayers were obliged to exchange electronic invoices.

If you are working in an international organization it is important to stay compliant with the law of the countries you are operating in. Failing to comply with these regulations can result in unnecessary penalties and operating costs for your organization. Besides that, last-minute implementations can disrupt your resource planning and delay other important projects.

With this in mind, the current trend and expectations of upcoming mandatory electronic invoicing it is important that your organization finds out about new regulations and implements the necessary technical aspects well before the deadline.

Four ways to approach global e-invoicing compliance

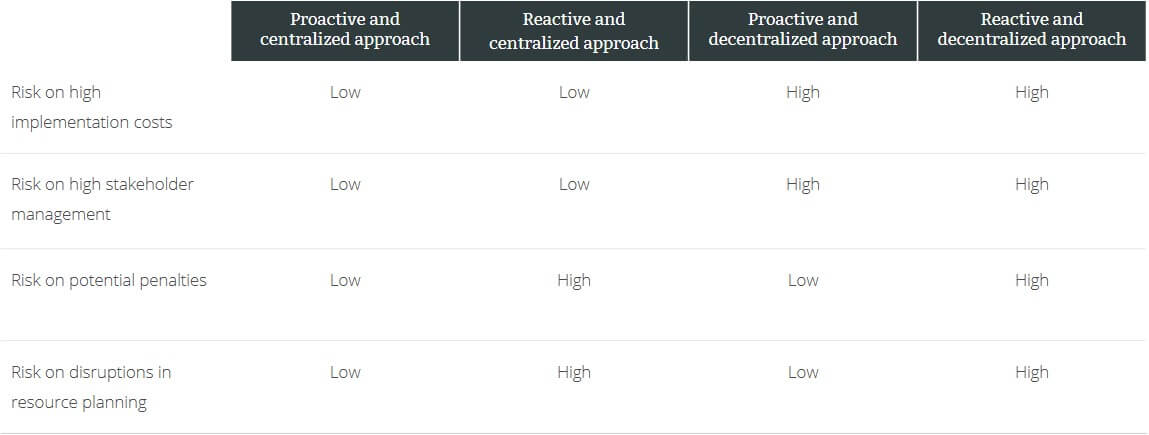

Over the past couple of years, I have advised multiple international organizations on global e-invoicing. From my experience, there are four ways to approach global e-invoicing compliance. These four ways are influenced by the following factors: Proactive vs Reactive and Centralized vs Decentralized as seen in the model below:

- Proactive and Centralized approach. From my perspective, the best way to handle global compliance when it comes to e-invoicing. Proactively adapting to the regulations and centralizing the technology needed in one tool will result in better resource planning, minimal risks, and low implementation costs in the long term.

- Proactive and Decentralized approach. This approach is neither good nor bad. But imagine having every local office deciding on their own e-invoicing tool. This can result in complicated stakeholder management. It may look like it will save implementation costs in the short term, but in the long-term, it will end up in higher implementation costs.

- Reactive and Centralized approach. This approach is only sustainable if you are present in a few countries. It becomes an issue when you are active in more than ten countries. In one year multiple of these announce mandatory regulations or technical changes to current legislation. As mentioned before, finding out too late about these regulations can disrupt your resource planning and delay other important projects.

- Reactive and Decentralized approach. One of the most common but not recommended approaches. The risk of finding out too late about upcoming regulations is too high. And when every local office selects its own e-invoicing tool, you can end up with all of the potential issues, such as the disruption of your resource planning, possible penalties, and extensive stakeholder management. Furthermore, last-minute anticipation can lead to critical errors.

Choose your strategy wisely

When working for a multinational organization, it is important to stay up-to-date on all current and upcoming e-invoicing regulations, especially now that countries are rapidly introducing mandatory e-invoicing. One of the ways to stay up to date is by using a global knowledgebase like electronicinvoicing.global.

Besides that, it is important to implement the best and future-proof approach to handle upcoming e-invoicing mandates. The approaches mentioned above serve as a guideline. But it could be the case that approaching e-invoicing in a reactive and centralized way or proactive and decentralized way works best for your organization, just because of the way it operates.

Nonetheless, if you do not know whether your approach is the right one, or if you are struggling to adapt to new regulations, feel free to contact us.

Related content

-

Blog

The inconvenient side of ESG investing

-

Blog

UK pilot program for sharing bank branches

-

Article

Xavier Gabriëls: ‘Businesses don't have the luxury of choosing which challenge to focus on. They have to tackle them all’

-

Article

Three Hacks to structurally improve your Credit & Collection

-

Blog

"The world of bookkeeping is exciting"

-

Article

Five reasons to work with 'Zoomers’