- Renegotiate Payment Conditions

- Review Payment Stretch requests

- Re-think Dunning Business rules

At the outset of the Covid-19 crisis, TriFinance launched a series of online Expert Sessions to share knowledge in areas that were likely to be impacted by the corona pandemics, such as working capital management and cash flow forecasting; credit and collection, and risk management, also focusing on solutions that might make your organization more resilient, like RPA, the adoption of digital or business process management.

During the Credit & Collection session, TriFinance experts suggested three hacks to structurally improve a company’s working capital:

- Renegotiate Payment Conditions

- Review Payment Stretch requests

- Re-think Dunning Business rules

TriFinance working capital expert Benjamin Celis discussed the impact of the crisis on payment conditions, explaining how to deal with requests from customers to stretch payment, and how Credit departments should rethink its dunning business rules. Project consultant Michiel De Weerdt covered the impact of Credit Management tools, explaining how tweaking their setup can help Credit managers to focus on elements that have the biggest impact on the company’s working capital. The session was chaired by CFO Services client partner Filip Ceulemans.

Three Hacks to Corona-proof your Credit & Collection

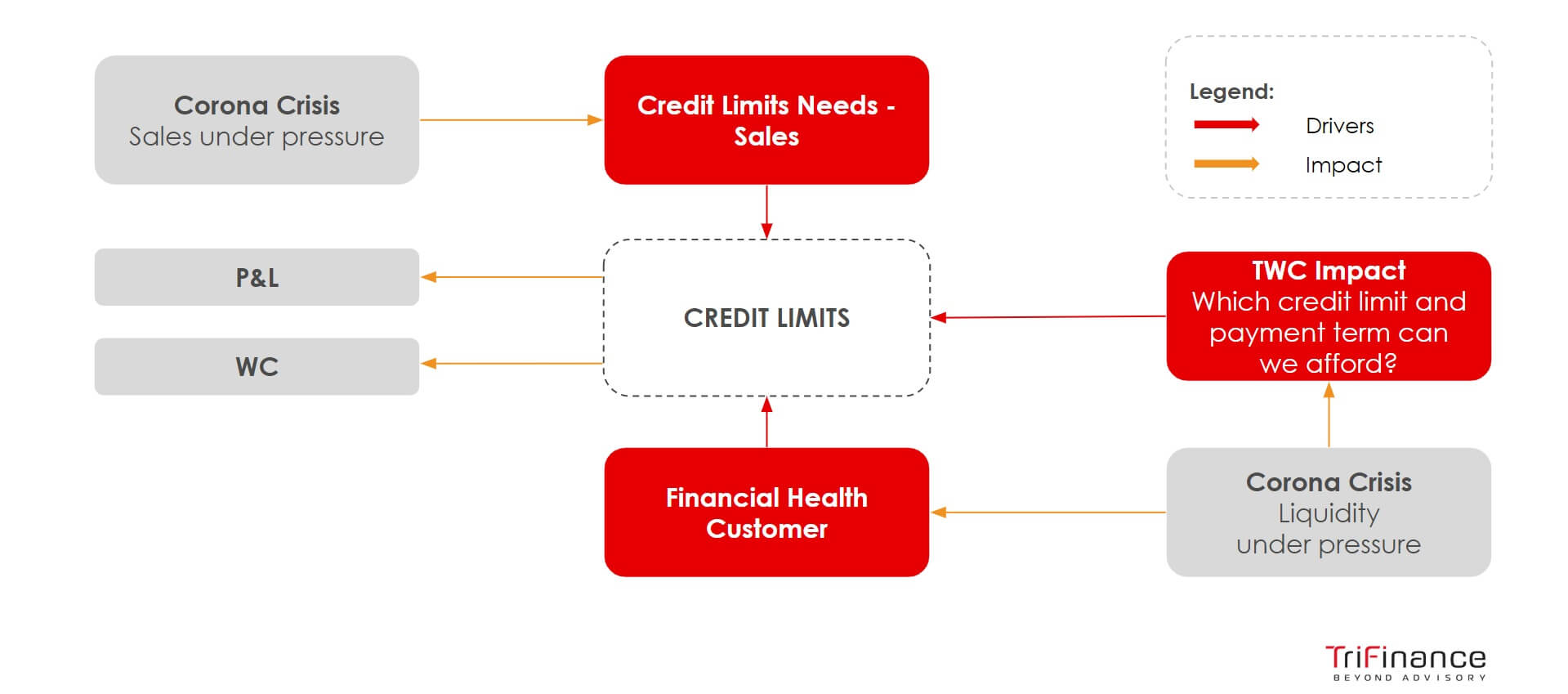

Credit limits are used as an instrument to manage your accounts receivable and risks. The classic view on credit limits is that they are driven by the credit limit needs of the sales team and the financial health of the company’s customers. Both are impacted by the corona crisis, as is the working capital. While setting the credit limits, beside assessing the financial result, one should also take into account the own working capital charge.

With the current crisis possibly weakening the Trade Working Capital (TWC), finance professionals should check the credit limit’s impact on that working capital. A customer with a 1 million Euro credit limit, for instance, will have a completely different impact on the organization’s liquidity than a customer with a credit limit of 10.000 Euro. How to renegotiate your payment condition and how to deal with stretched payment terms of your customers are two subjects captured below in the first and second hack

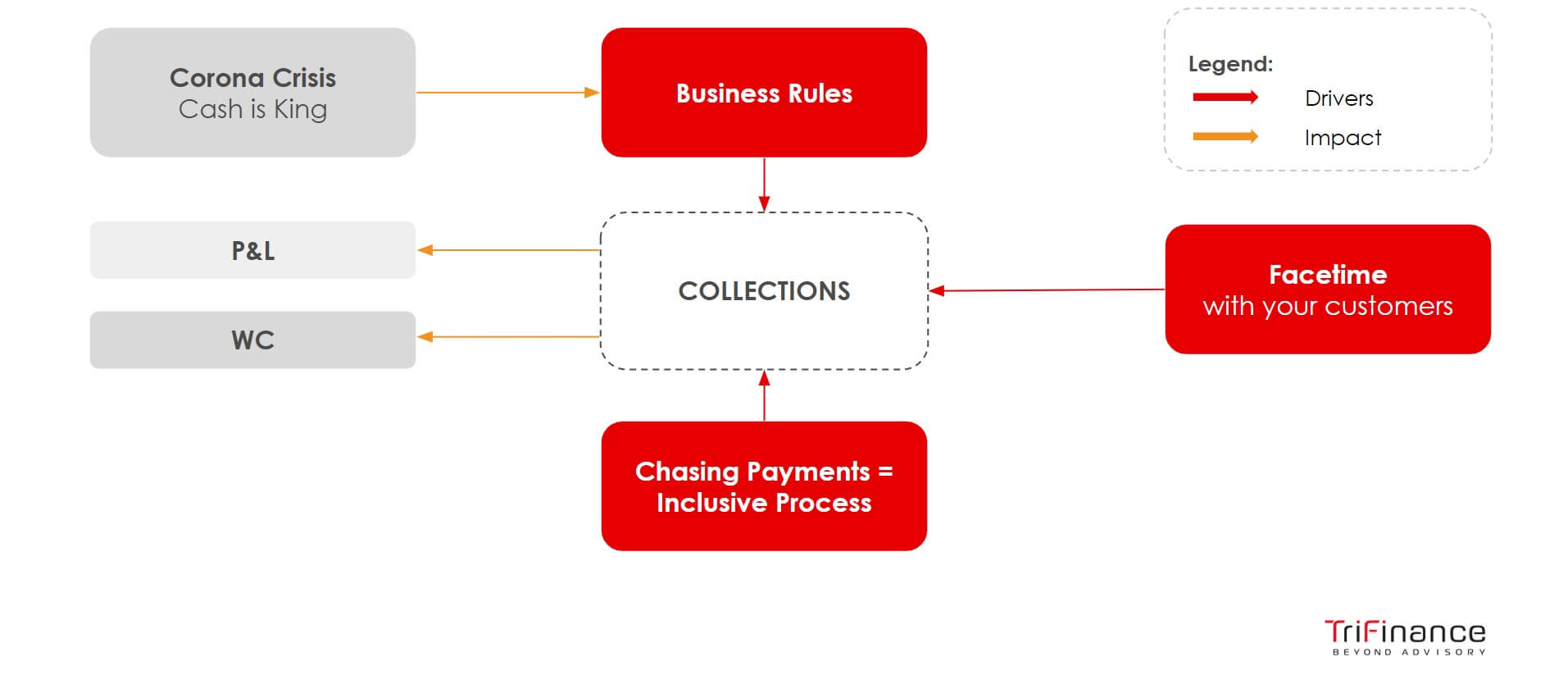

In its turn, the collection process is driven by the business dunning rules the company has installed, by facetime with customers and by the fact that chasing payments is an inclusive process. Collection is not the sole responsibility of the Credit department. Both the Sales team and the Customer Service department should be included in the process.

Business rules will definitely be impacted by the Corona crisis. Cash being important in the pre-corona era, Sales nevertheless was King. The Covid-19 crisis has changed business environments in such a way that cash is many companies’ first concern. If you don't have the necessary cash, essential company processes won’t run. Business rules that were set up under the old normal, will have to be redeveloped to better serve your working capital.

Hack #1 Renegotiate your Payment conditions

Because a customer with a credit limit of for example 800.000 euros has a big impact on your working capital, giving a shorter payment term is an option. Customers with a low credit limit, can be given a more extended payment term. Their individual impact on a company’s working capital is relatively small.

But credit is also a sales tool. Not giving any credit will be detrimental to your sales. In today’s crisis, it’s all about finding the best balance between working capital impact and sales. Going through the top 20 of your customers, you can check which customers are taking up the bigger amount of working capital, trying to reduce it by negotiating different payment terms. Solutions could be to reduce payment terms or lowering credit limits.

Hack #2 Review payment stretch requests

In corona times, companies undoubtedly get requests to stretch payment terms. Creating a forum in your company to regularly review requests and credit limits could be a way to deal with this. It should be done with all stakeholders, including treasury, credit and collection, your credit manager and CFO.

Clear boundaries should be drawn to determine the possible stretch of payment requests. One participant mentioned a lot of their customers impacted by Covid-19 were asking for payment delays because they didn’t have the money or the people available in the Finance department.

Credit & collection expert Benjamin Celis suggested a differentiated approach, depending on the type of customer the organization is dealing with.

‘The best approach,’ Benjamin Celis said, ‘is to negotiate, working towards a win-win situation. Pushing a customer to pay makes no sense if that company eventually goes bankrupt. You end up with a write-off. Better to offer that customer a short delay, but within boundaries. The biggest advantage of this approach is that you create loyalty, because the customer will remember this after the crisis, and can perhaps generate more business later’.

‘It is all about finding the right balance,’ Client partner Filip Ceulemans says. ‘Use that forum in your company to have a discussion on a regular basis with the key stakeholders in the entire process, sales, and finance all together to come to the right action.’

A clear delegation of authority is necessary to know who can decide on which request; and who must be informed of the stretched payment term.

A few tips:

- Assess each request individually. Always look at the impact on your working capital: can we afford it; how long will the stretched payment last? Is the customer financially healthy or not? If the customer is not financially healthy, then why grant him extended payment terms. Chances are you will have to face write-offs.

- Don't confuse the need for a payment plan with extended payment terms. Both need a different approach.

- Big key accounts have a big working capital impact. A specific approach is needed. It’s important to limit the extended payment term in time, put it on paper, and have it signed. Try to mitigate the non-payment risk. Work with scenarios.

Hack #3 Rethink your dunning business rules

Before the Covid-19 outbreak, companies had their dunning business rules running on autopilot with the system deciding who to call and which action to be taken.

Under existing business rules, companies were likely to treat all customers the same way, using some specific categorization developed in a pre-corona business environment. With today’s primary focus on working capital, companies might question the validity of this categorization and the proposed treatment.

Most categories in existing dunning business rules are based on key accounts and payment risk factors, basically being P&L-driven. In today’s setup companies might want to develop categories based on working capital.

Business rules do what they have been programmed to do, so there is a low sense of urgency. Companies now need to shift gear quickly. Credit controllers should be in charge, as they know best who is trustworthy and who is not trustworthy. So, agility is key.

Most categories in existing dunning business rules are based on key accounts and payment risk factors, basically being P&L-driven. In today’s setup, companies might want to develop categories based on working capital.

Benjamin Celis, Working capital expert

The importance of face time with your customers

One participant working at the Accounts Receivable department of a shipping company said they were using a dedicated Credit management tool, but emphasized it is essential to use common sense when contacting customers and not depend solely on the tool. Knowing your customer, their payment behavior, and the way they will facilitate coming to an agreement. She preferred face time and direct calls to emails: ‘It is really important to talk with your customers,’ she said. ‘You can contact them by phone even when they are working from home or use the tool. It can be frustrating to only receive emails. It creates distance, because it’s still a more formal approach.’

It’s pretty self-evident that the Credit controller would be asked by the CFO or treasury department to engage in cash flow forecasting and incoming payment. The remaining time should then be used as well as possible. Better not to waste too much time on small overview invoices with a high risk of non-payment as the working capital return rate there is very low.

Better maybe to send this kind of invoices straight to a collection agency under a No-Cure No-Pay agreement, making it possible for collection experts to be redirected towards customers with a high return rate in terms of working capital.

Business rules not only have to be re-thought, but they also have to be implemented, a fairly easy task for companies with a manual dunning process. All it takes is to rewrite the procedure and ask credit controllers to follow it. Companies already using a CM dunning tool, have two possibilities. They can install an extra layer on top of their CM tool, doing the analysis themselves, putting prioritization upfront. Or they modify the existing business dunning rules inside the CM tool.

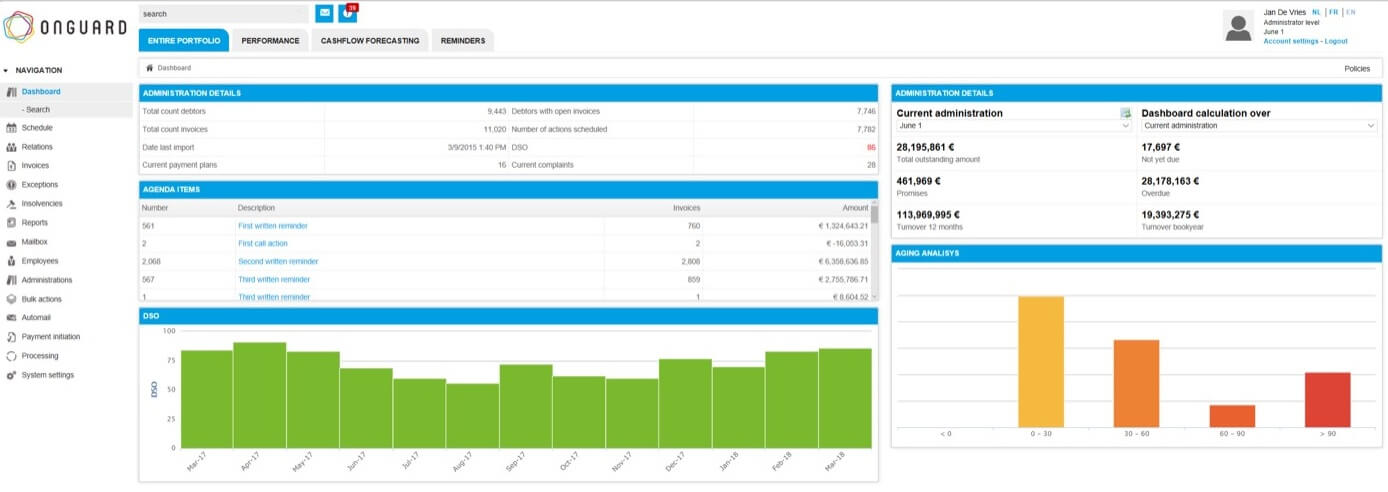

The Credit management tool: A single source of truth

A credit management tool can really function as an integrated platform. Companies that still work manually will often use spreadsheets, mailboxes, and shared drives. Because the information will generally be scattered across the organization, the tool will help to create one single source of truth, not only in the credit department but throughout the organization.

Enhancing transparency across departments, information can now be exchanged between credit departments, sales, customer service, other finance departments, the CM tool functions as a platform using integrated mailboxes, assigning viewer rights etc.

A CM tool allows organizations to automate their Credit and Collection process where possible. For smaller amounts or smaller-risk customers, automation will prevent collectors from losing too much time. In times of crisis, when you want to be vigilant on how to approach other customers, a CM tool can facilitate communication through this kind of segmentation.

Managing disputes on invoice level in a CM tool often decreases the time needed to solve these issues as they can be logged by a collector. The CM tool will centralize all information.

ERP and Best-of-breed packages

A CM tool can be put on top of an ERP system like SAP, which is a top-notch ERP system but often not really easy to manage for customer follow-up. Sending reminders or working with a lawyer who is sending reminders in a third phase is difficult to integrate. For SAP, credit and collection is the last part of their process, often containing only a limited number of features which limits the collector in her actions. The cost of making changes to the system is often mind-blowing.

Fundamentally, SAP is not a collection tool. Collection tools like Onguard’s Credit Manager are created to facilitate the credit and collection process. They have specific functionalities. A lot of processes and modules can be used, not only workflows and general dunning strategies. Payment plans and their follow-up can be put in place, dispute management can be arranged. In a fully configured SAP environment, it is of course possible to build a sort of collection tool in SAP, but the cost of that will be 10 to 15 times higher than installing a collection tool.

Best-of-breed packages offer functionalities not to be found in SAP or only to be created in a very cumbersome way. SAP certainly has nice dashboards on DSO, aging etc. but best of breed credit management tools have strong communication options to follow up on customers, with emails being automatically triggered and sent, responses that come in that will be linked to specific customers, etc.

Other functionalities include setting up payment plans that are really agile, to be used on different invoices because SAP only allows payment plans to be made for one single invoice. They are really integrated Credit Management tools that enable Credit and Collection experts to properly follow up whatever happens with your customer.

Optimizing the system configuration

When moving into an agility mode in today’s crisis, Credit managers can consider a couple of hacks with respect to system configuration, allowing credit experts to work more efficiently:

- Create separate workflows or separate processes with a different dunning strategy for different target groups. This could be done for certain customers, for shorter terms between actions like the first letter action vs the first call action. Shortening these terms, communicating more or sending letters through email instead of regular mail are more efficient in times where many people work remotely.

- Set up and configure new payment terms and payment plans for customers that might insist on stretching payment terms, aligning them with the credit policy. A CM tool can be of great help here. Make sure collectors are really following the policy that has been determined.

- Install or optimize the dispute management process. This could mean that the Credit manager has to install formal escalation points or stricter deadlines for follow-up. Disputes should be managed really close, so they can be solved more quickly, enabling the company to collect cash more efficiently.

Incorporate payment links in your dunning letters giving customers the opportunity to to pay directly through their mobile phone or via the internet applications. That can really speed up the payment process of your customer invoices.

Integrating the credit scoring

Most applications are able to receive information from credit information providers like Graydon, Dun and Bradstreet or CreditSafe. Some are capable of implementing the information directly into the system, which means these reports can be viewed directly in the CM tool.

Others can be set up through an interface, permitting the credit scoring from the ERP system to be transferred to the CM Tool. Companies that want to go further can integrate the scoring model into their system dunning strategy. A customer’s credit score decreasing below a certain threshold will then, for example, put the customer on the radar. The tool will decide whether the customer has to be put on a different dunning strategy, pushing the Credit department to communicate differently with that customer.

It makes sense to set up a periodic reporting of customers passing thresholds or KPIs. It also offers a clear view of customers and their payment behavior. That way, the Credit department can keep track of who is impacted by the crisis.

Finally, it is crucial to acquire technical knowledge of the Credit tool and to get it in-house. Appointing a key user who can combine business knowledge with the knowledge of the technology the credit team is using can really give a boost to the credit function, helping the Credit department to collect cash more efficiently in these difficult times.

Related content

-

Blog

The inconvenient side of ESG investing

-

Blog

UK pilot program for sharing bank branches

-

Article

Xavier Gabriëls: ‘Businesses don't have the luxury of choosing which challenge to focus on. They have to tackle them all’

-

Article

Three Hacks to structurally improve your Credit & Collection

-

Blog

"The world of bookkeeping is exciting"

-

Article

Five reasons to work with 'Zoomers’