In a highly competitive industry like telecommunications, success relies on innovation, fast decisions, and sound risk management practices. To strengthen its position across a wide range of commercial segments, Belgium’s leading telecom company Proximus decided to roll out a pricing clearance framework to guide, accelerate, and control pricing decisions.

Key criteria for a successful partnership

For the design of the new pricing policy and management framework, Proximus partnered with TriFinance's CFO Services. The company was looking for a partner with experience in process improvement and compliance. Key criteria for a successful partnership were the ability to combine a helicopter view with pragmatism, and knowledge about everything digital.

TriFinance's expertise in policy and process optimization combined with their pragmatic approach were key success factors for this assignment

Ann Maes, Regulatory Manager, Proximus

Rolling out a company-wide pricing framework

As one of the most recognized brands in Belgium, Proximus employs nearly 13.000 employees with revenue of approximately 5.5 billion euro. The company operates on a large scale and serves millions of corporate and retail customers. The financial and commercial success of such a diverse customer portfolio depends on a strong and effective pricing strategy.

‘Rolling out a company-wide pricing framework for one of the country's most prestigious companies, I was confronted with the complexity of reconciling the needs of multiple stakeholders into one single policy,’ says project consultant Florimond Vermeulen. ‘The project confirmed the importance of policies to guide and empower managers and employees.‘

For this project, TriFinance partnered with the Regulatory Manager at Proximus who has a wide knowledge of the sector and the company and knows the stakeholders. Her knowledge, combined with TriFinance’s experience in policy management, internal controls, and process improvement led to effective collaboration.

‘Prior experience in risk advisory proved really useful,’ Florimond says, ‘as I had often evaluated policy compliance. This engagement provided the opportunity to sit on the other side of the fence.’

Building the project plan

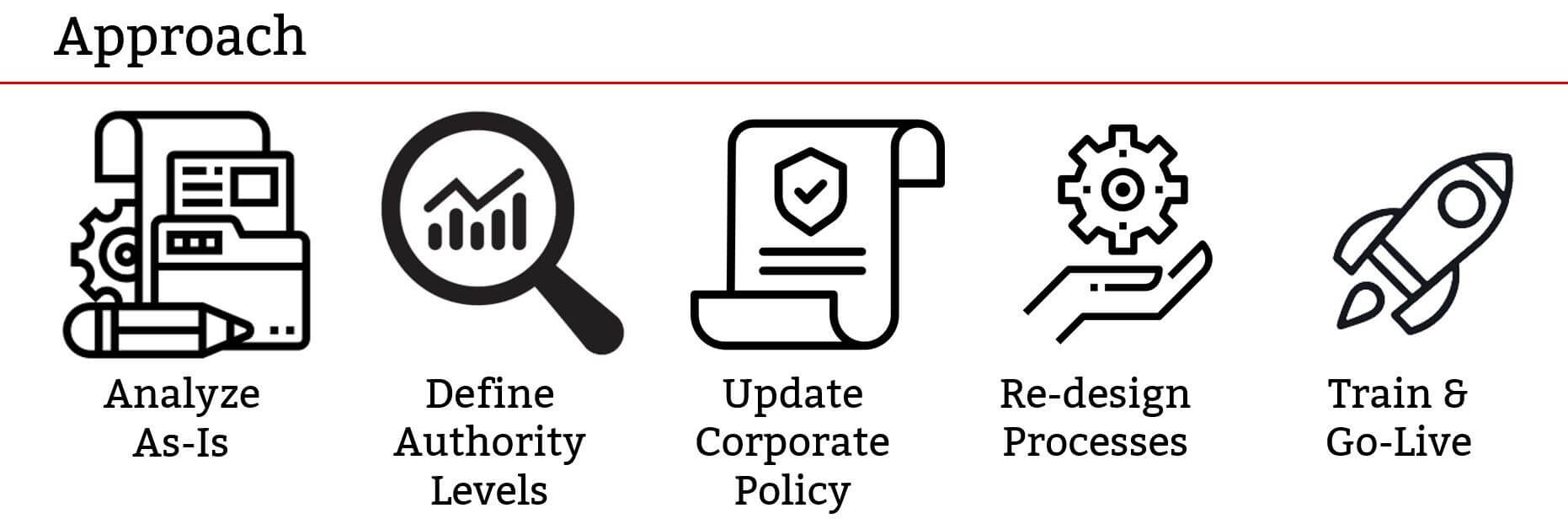

The project team started by connecting to the pricing community. Across the different business units and supporting departments, documentation relating to current processes was gathered, analyzed, and structured. Starting from the as-is situation, a project plan was built for the next 6 months.

Reviewing the pricing policy

During the second stage of the project the pricing authority levels were redefined and the CEO Delegation of Powers was updated for all matters related to the pricing decision-making process.

Next was the review and update of the pricing policy for the various business units. The policy guides all steps of the pricing process, from initiation to senior management sign-off.

Policy requirements were then incorporated into the various departments’ procedures and systems. During this phase, TriFinance guided Proximus business people to establish clear documentation and controls. Adjustments were made to ensure compliance with the new policy and delegation of powers requirements.

The policy is now part of the company's top policies. Pricing is set as a core contributor to Proximus's corporate image, competitiveness, and financial performance.

The creation of a dedicated Group Pricing Manager role

In the final stage, the new policy and procedures were communicated throughout the company. Roadshows and digital learnings were prepared and used to spread the message at all levels of the organization to ensure a high degree of awareness. In addition, control steps and periodic reports were designed to continuously monitor policy compliance. The project culminated with the opening of a dedicated Group Pricing Manager role to govern pricing decisions and support the business units in fulfilling the requirements of the new policy.

The policy is now part of the company's top policies. Pricing is set as a core contributor to Proximus's corporate image, competitiveness, and financial performance.

CFO Services Risk Management & Process Improvement expertise

For more info on our risk management expertise - you can contact Jean-Marie Bequevort at jean-marie.bequevort@trifinance.be, and for information on our process improvement expertise, you can always contact Filip Ceulemans at filip.ceulemans@trifinance.be.

Related content

-

Blog

5 reasons why TriFinance is the perfect EPM partner for your organization

-

Article

"ESG reporting is not a compliance project"

-

Blog

Why Ask Why?

-

Article

Embracing the Future: 5 Key Evolutions in Project Management.

-

Reference case

From process screening to process optimization and robotization

-

Article

3 strategies to keep your (experienced) finance talent on board. Lessons from CFO’s.